After a torrid run this year, metals and mining stocks are about to take a big leg lower — according to one trader.

In a sizable trade on Thursday, someone bet more than $5 million on a nearly 35 percent decline in the S&P Metals and Mining ETF, the XME. In the specific wager, the trader bought more than 50,000 of the September 20/15 put spreads for $1.12 each. Since each put option accounts for 100 shares of stock, this is a $5.6 million bet that the ETF will fall as low as $15 by September. The ETF is currently trading around $23.

The XME is up more than 50 percent in 2016, driven by massive moves from some of its biggest holdings. Cliffs Natural Resources, Coeur Mining, U.S. Steel, Consol Energy and Freeport-McMoRan are up a respective 143, 220, 140, 91 and 77 percent year-to-date.

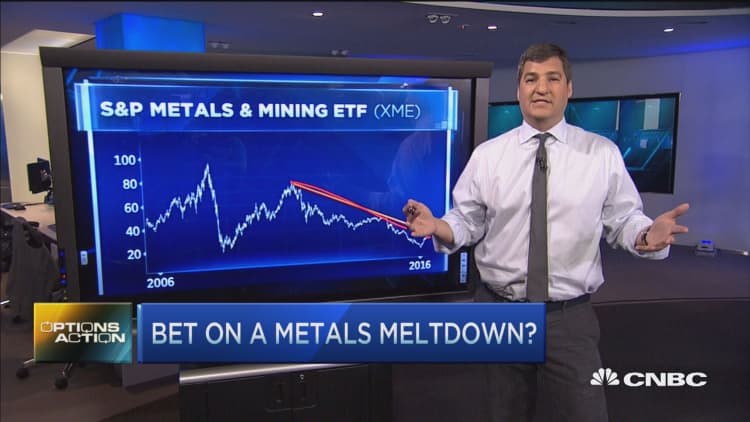

"The XME had broken down at this $25 level. It went all the way down [to $11 a share] and then had an almost 100 percent rally back," Dan Nathan told CNBC's "Fast Money" on Thursday. The metals and mining ETF is down more than 8 percent from its 2016 high of around $25 hit on April 28. "If you look at the decline it's had in the last week and a half and then you look at the long-term downtrend, you see it's failed right below that," explained the founder of RiskReversal.com. "This kind of bet could be a downright bearish bet looking to get some leverage to the downside," he added.

The XME was higher by more than 1 percent early Friday.