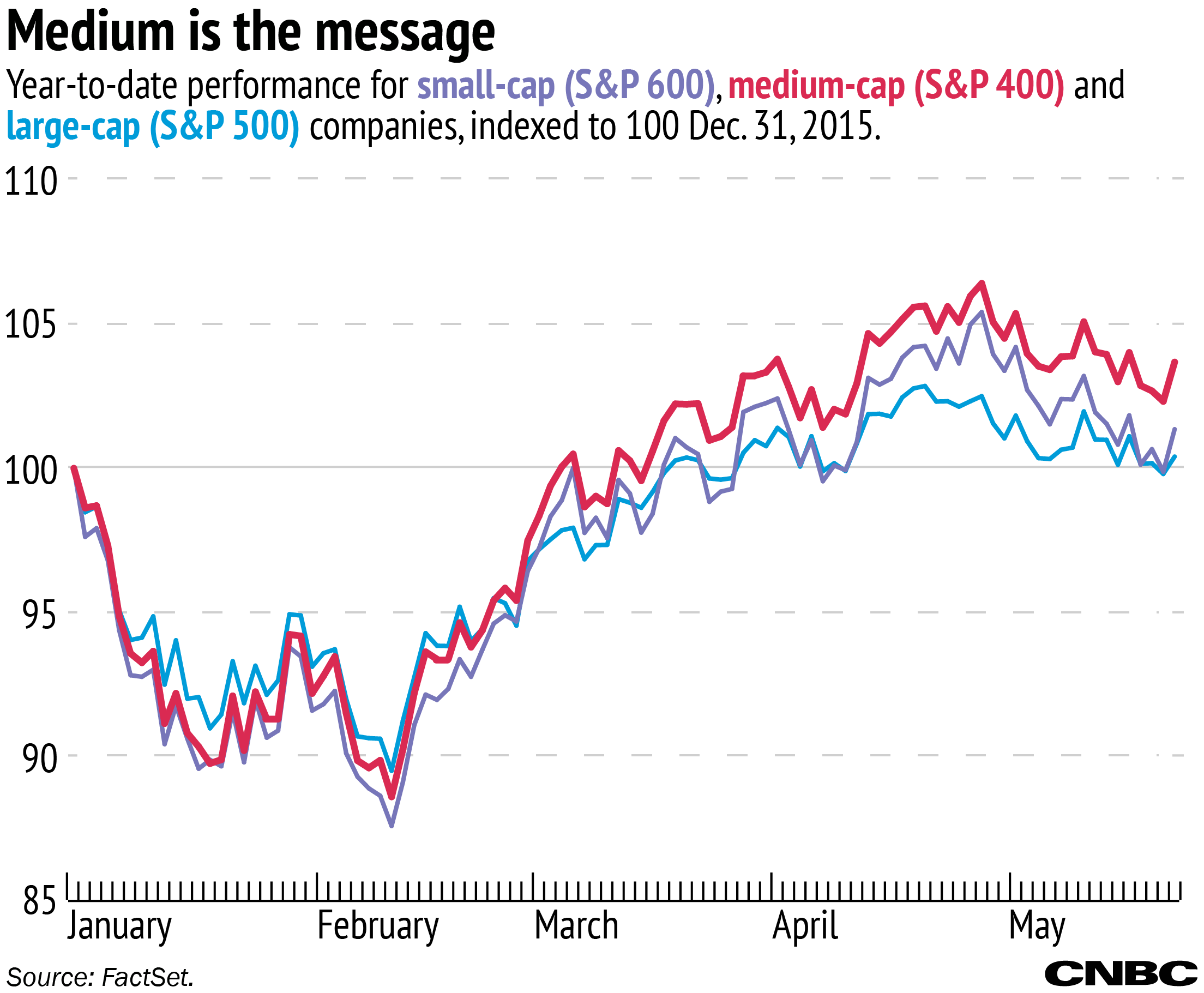

If you're looking for portfolio returns this year, it might be best to look for stocks that aren't too big or too small.

Think of it as the Goldilocks investing strategy: Shares in companies that are the largest or the smallest among publicly traded companies aren't showing performance like medium-sized companies. The S&P 400, an index of mid-cap companies from across the U.S. economy, is up 3.7 percent this year, as of the close Friday. Compare that with small caps up 1.4 percent and the more popular S&P 500, an index of big-cap companies, up just 0.4 percent.