Thursday's stunning Brexit vote threw global markets into a tailspin, as investors reacted to the unprecedented uncertainty of a country pulling out of the European Union. The FTSE 100 fell as much as 8 percent. The S&P 500 fell 2.4 percent in the first hour of trading.

The British referendum could seem to Americans like a provincial problem. But from the perspective of many American companies, the British are employees and customers. The vote to leave the EU could have a significant effect on corporate America's bottom line.

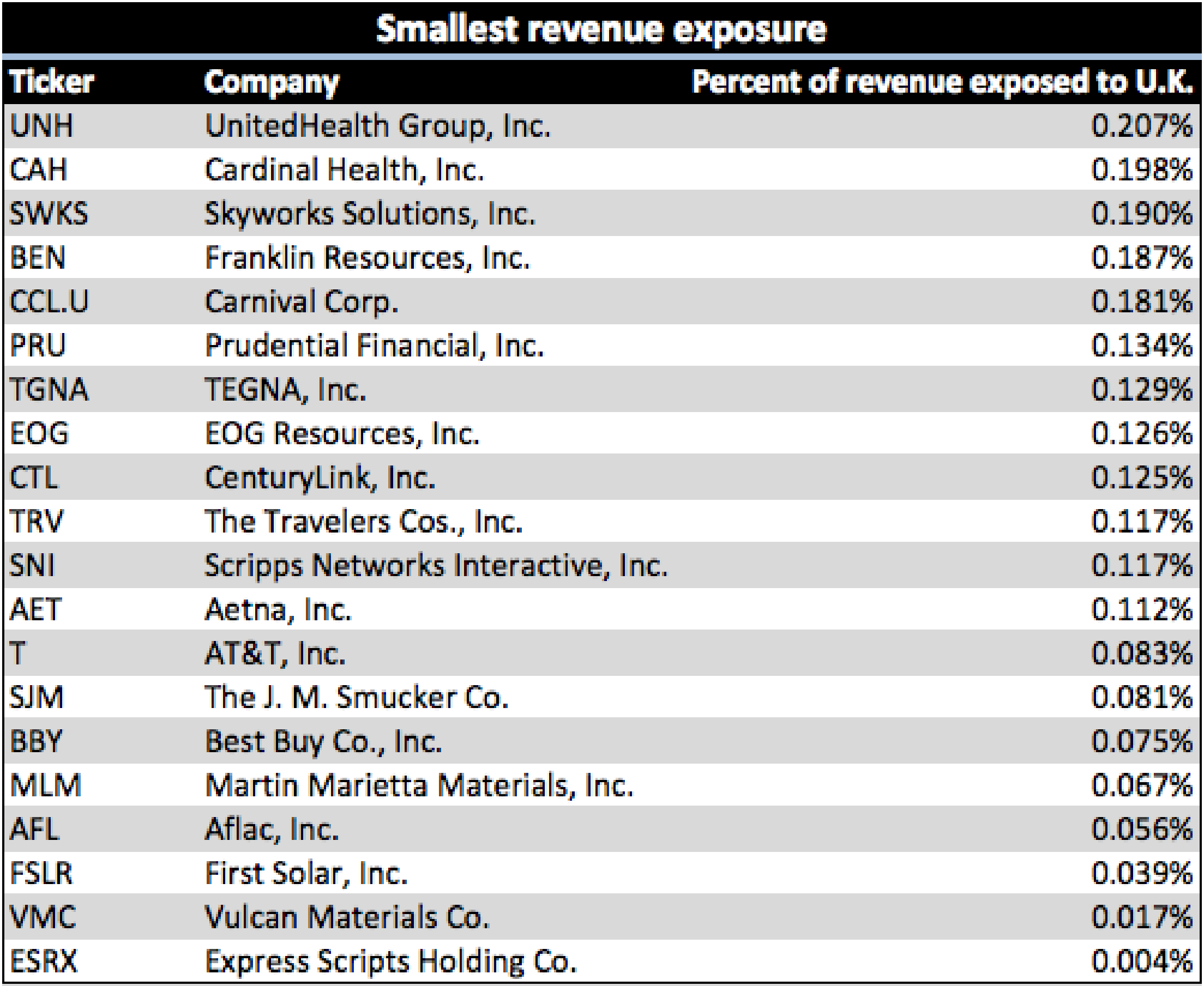

A number of companies in the S&P 500 have significant revenue exposure in the U.K., and investors are noticeably nervous.