The market is behaving as if private prisons have received a death sentence, but they may soon be out on parole.

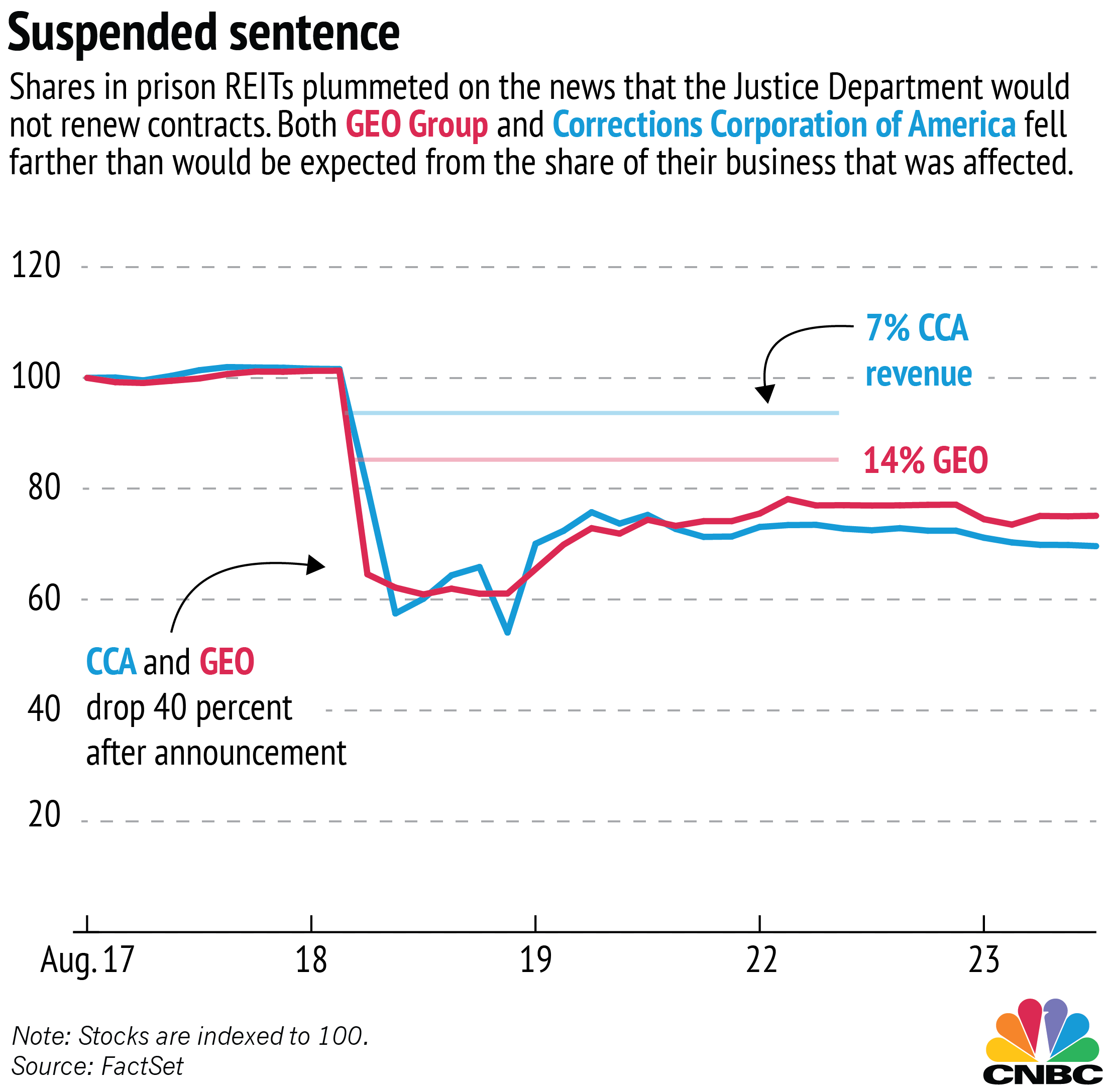

When the Justice Department announced last week it would end its use of private prisons, investors abandoned their prison positions like escaping convicts, cutting 40 percent off two publicly traded prison companies in a few hours. Corrections Corporation of America and GEO Group are still down around 30 percent from that point, yet there is no reason to think they've lost that kind of value.

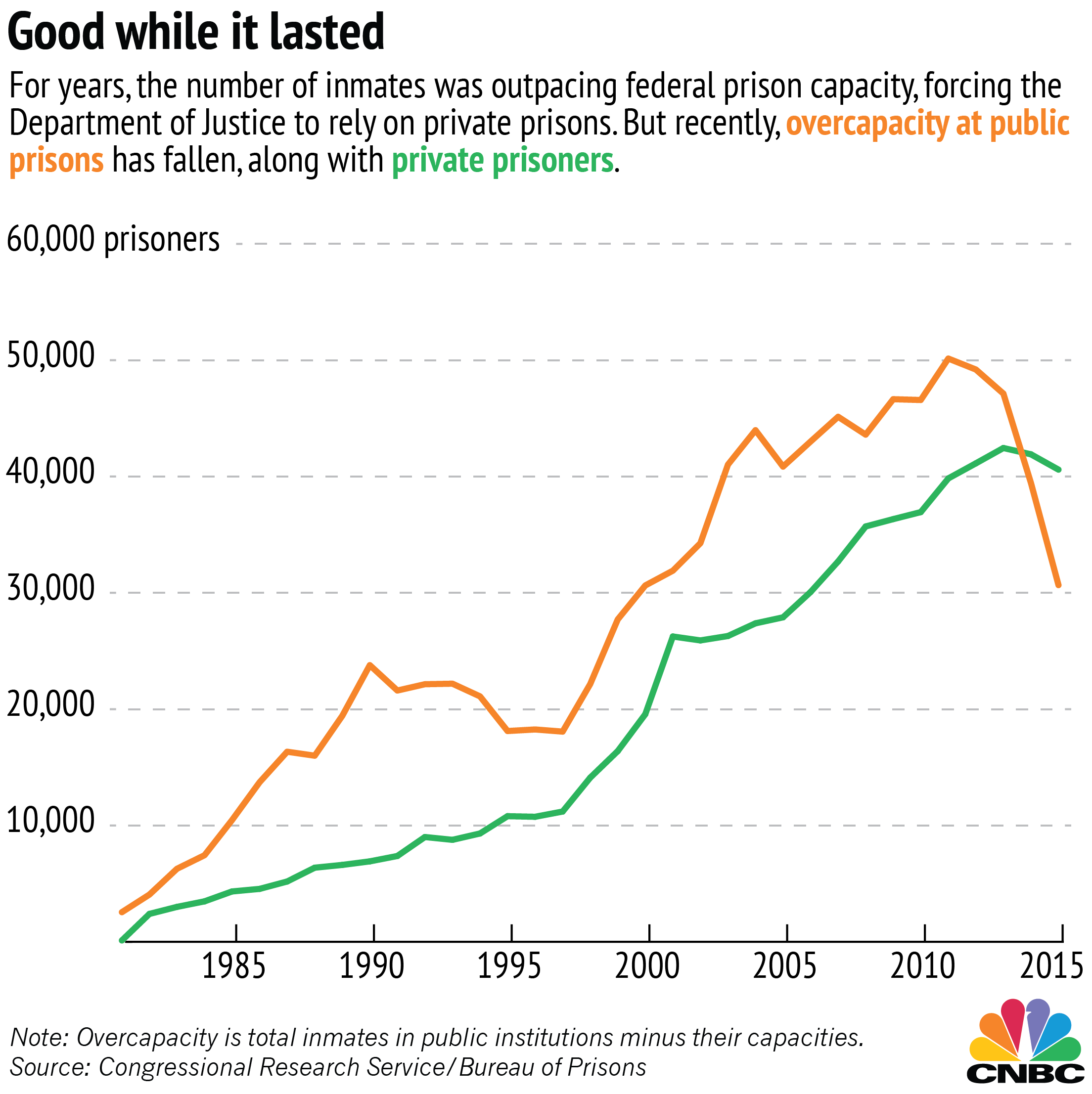

That's because the eventual end of the companies' nine Bureau of Prisons contracts account for only about 13 percent of their combined prison capacity, according to company filings and CNBC calculations. They make up about the same amount of the companies' total earnings before interest, tax, depreciation and amortization, according to analysts at Canaccord Genuity.

So the two companies will lose contracts for nine facilities out of more than 180. GEO will lose about 15,000 beds, representing about 14 percent of the company's annual operating revenues, according to the company. CCA will lose around 6,000 inmates, or about 7 percent of revenue, according to CCA.

So why is the market posting 30 percent declines?