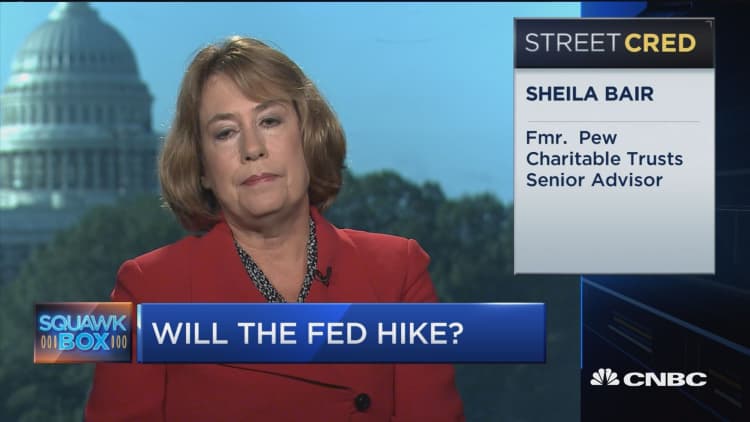

Wells Fargo has not done enough to address the problems brought to light in its massive settlement over secret accounts, former FDIC Chair Sheila Bair told CNBC on Tuesday.

"If you're going to use clawbacks, this would be the situation," Bair said, referring to possibly recouping any compensation fired employees received as a result of creating fee-generating accounts for unsuspecting customers in order to reach sales and bonus targets.

Carrie Tolstedt, the Wells Fargo executive in charge of the unit where employees opened as many as 2 million unauthorized customer accounts, retires at the end of the year, according to a bank announcement in July.

Fortune had originally put a value on her accumulated stock and options over her career at $124.6 million. But according to a Wells Fargo proxy statement, the number is closer to $95 million, based on when the stock was trading around $49 per share last week.

Mary Eshet, spokeswoman for Wells Fargo, told CNBC that Tolstedt was not available for comment.

Last Thursday, Wells Fargo said it has agreed to pay $185 million in fines to the Consumer Financial Protection Bureau, the Office of the Comptroller of the Currency and the city of Los Angeles, as well as $5 million to customers who were affected.

"Money drives behavior," Bair said. "Boards and senior management need to be aware of the compensation incentives they're putting in place and monitor those."

Wells Fargo on Tuesday said it would eliminate retail banking product sales goals, starting next year.

Hours later, the bank's CFO, John Shrewsberry, blamed underperforming employees struggling to meet goals for the lapses. Speaking at a banking conference in New York, he said 10 percent of the 5,300 employees fired were branch managers or more senior staffers.

"The perception is a lot of low-level people lost their jobs, without any accountability among supervisors and up the management scale," Bair said on "Squawk Box," ahead of Shrewsberry's speech.

"That sends a very bad signal to employees about what kind of behavior is rewarded and what is penalized and who is held to account and who isn't," added Bair, now president of Washington College, a Maryland liberal arts school.

Bair was appointed by President George W. Bush in 2006 to run the Federal Deposit Insurance Corp., an independent agency created by Congress. The FDIC insures deposits and supervises banks as part of its mandate to maintain stability and public confidence in the nation's financial system.

Meanwhile, Treasury Secretary Jack Lew said Tuesday that cases like Wells Fargo are a "wake-up call for regulators." Speaking at the 2016 Delivering Alpha conference, presented by CNBC and Institutional Investor, Lew said no one should be "too big to jail."

Correction: This story was revised to correct that Carrie Tolstedt will retire at the end of the year, according to Wells Fargo. It also was revised to provide a lower value of her stock and options, based on a Wells Fargo proxy statement.