The difficult trading environment on Wall Street in 2017 appears not to be getting much better, with Citigroup warning Monday that its revenue probably will be off 15 percent in the third quarter.

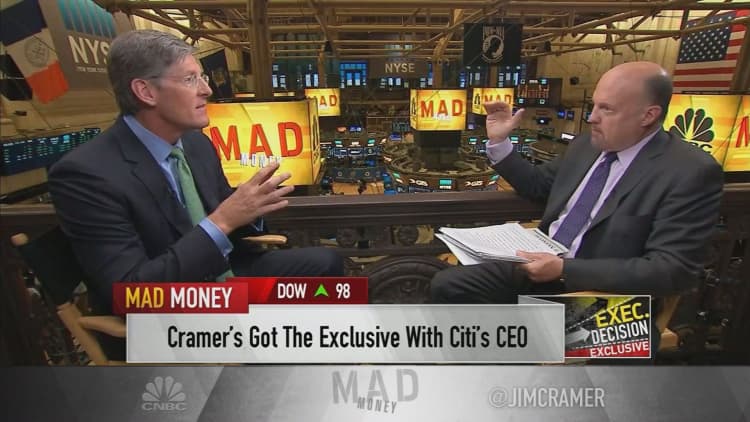

Speaking at a Barclays banking conference, Citi CEO John Gerspach predicted the decline amid subdued market volatility.

Gerspach said volatility "has remained somewhat subdued throughout this quarter, especially

when you compare it to the third quarter of last year where we had a lot of activity in the markets in the third quarter of last year, both on the heels of Brexit and then in advance of the U.S. elections."

"We're not seeing that right now," he added.

The market didn't seem to be bothered by the report, as Citi shares rose more than 2 percent in afternoon trading, about in line with where the rest of the industry stood.

In fact, Gerpsach's projections were only slight worse than the outlook from Barclays analyst Jason Goldberg, who projected a 12 percent decline for Citi. Trading in the fixed income, commodities and currencies business was expected to be weak again on Wall Street.

Goldman Sachs, for instance, saw a 40 percent decline in FICC revenue in the second quarter. Citi's Q2 trading revenue fell 6.4 percent.

Gerspach noted that he feels "really good" about investment banking revenues and said Citi continues to work on its equities business.

He also said talks in Washington about regulatory rollbacks are "very encouraging."