The top House tax writer on Wednesday signaled that Congress could still propose changes to a popular retirement savings plan in its tax bill, contradicting an assurance made by President Donald Trump.

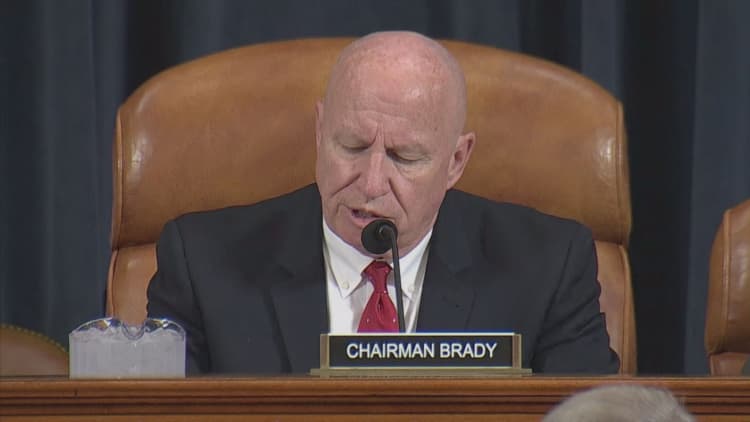

At a Christian Science Monitor event, Rep. Kevin Brady said Republicans are "exploring a number of ideas" to "create incentives for Americans to save more and save sooner." The House is "continuing discussions with the president" in that area, the House Ways and Means Committee chairman said.

"I do have a worry. Not enough Americans are saving," Brady said at a separate Yahoo Finance conference later in the day. Brady said Republicans have "asked for ideas how Americans (can) save more and save earlier in their lives."

On Monday, Trump emphatically tweeted that "there will be NO change to your 401(k)." He called the 401(k) tax benefit a "great and popular middle class tax break that works."

Brady did not specify the possible changes the GOP is considering.

Speaking to reporters Wednesday afternoon, Trump appeared to back off of his Monday tweet. He called 401(k) plans "very important" and said he did not want a proposal to change them to "go too far." However, the president said he could use 401(k) changes as a negotiating tool, adding that Brady "knows how important" the retirement plans are.

Brady said at the Yahoo event that he is not bothered by Trump's stance. "I'm certainly listening to President Trump," he said, adding that Trump has been "incredibly helpful" in putting together the tax reform bill

"At the end of the day, we're looking at encouraging people to save more and save early," Brady said. "We're looking through a number of ideas. No decisions have been made. At the end of the day, retirement will be strengthened or it will remain as it is."

Under current law, taxpayers can put a specified amount in 401(k) retirement savings plans without paying taxes upfront. Lowering the amount could help to raise tax revenue as the GOP looks for ways to offset across-the-board individual and corporate tax cuts.

The amount workers can contribute to a 401(k) rises to $18,500 next year, up from $18,000 in 2017. People age 50 and older can tack on a so-called catch-up contribution of $6,000.

The president prefers that changes not happen to 401(k) plans, but the White House cannot fully control the policy, a senior administration official told CNBC on Wednesday. The White House thinks the retirement tweak will fall out of favor but cannot guarantee that.

Aside from the 401(k) provisions, GOP leaders have also run into political resistance on a proposal to get rid of state and local tax deductions. Brady and House Speaker Paul Ryan both said Wednesday that they hope to find a way to ensure middle-class taxpayers in high-tax blue states who benefit from those deductions do not end up with a higher tax burden.

House Republicans aim to release a tax bill on Nov. 1, following the expected passage of a budget resolution Thursday.

On Wednesday, Brady did not answer whether Republicans would set a top tax rate for the wealthiest Americans, or the income brackets that will pay which rates, among other questions.

— CNBC's Eamon Javers and Jeff Cox contributed reporting to this article.

WATCH: Trump says 401(k) plans important to middle class