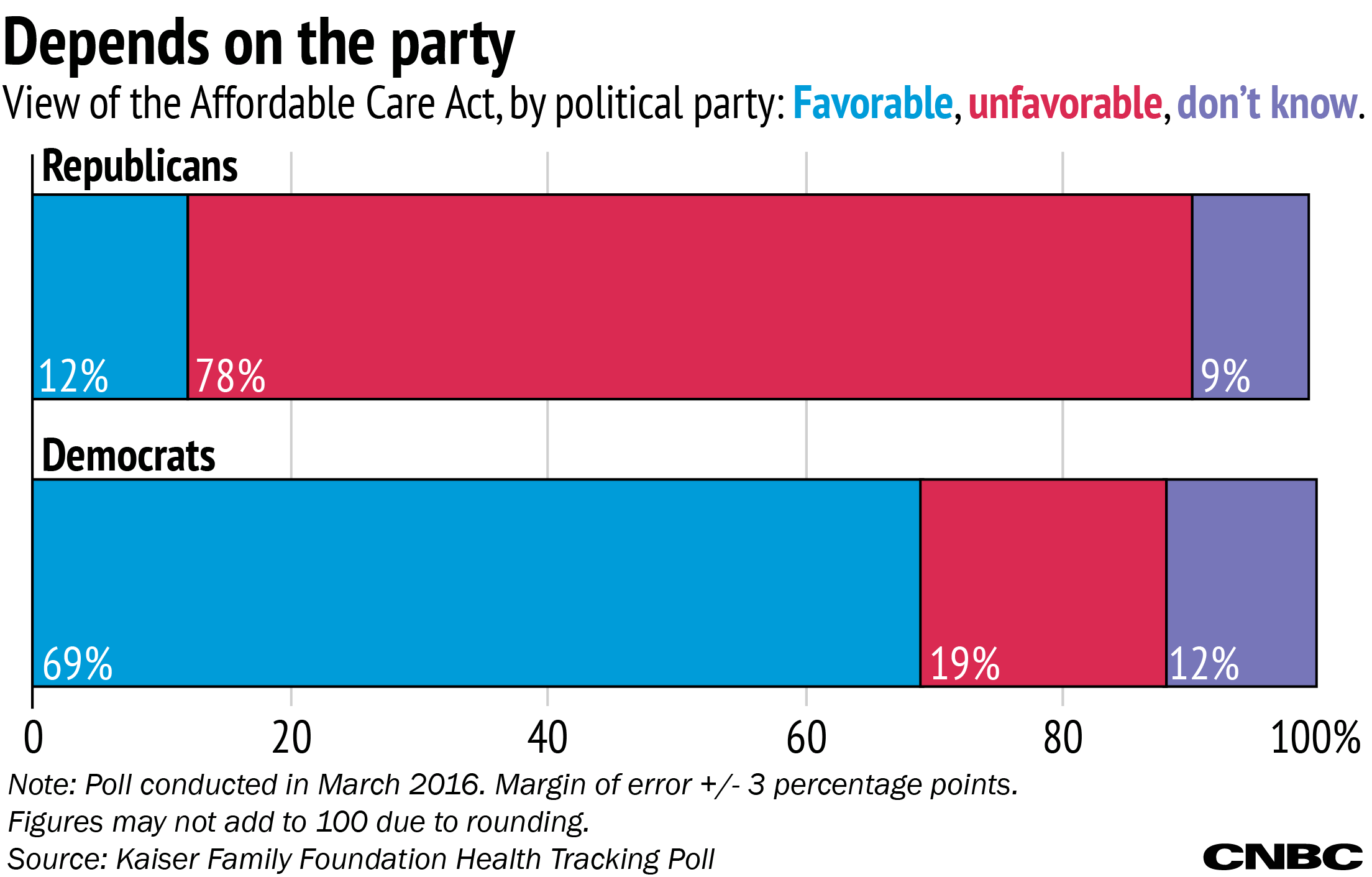

If you believe the Republican presidential candidates, the Affordable Care Act is a cancer and they're the chemotherapy America needs.

"Our health care is a horror show," Donald Trump said at a debate in January. "Obamacare, we're going to repeal it and replace it."

In Iowa, Ted Cruz told voters ACA is "the biggest job-killer in this country." (That claim was later rated "pants on fire" by Politifact.)

Republicans all have promised to "repeal and replace" or at least significantly revise the ACA.

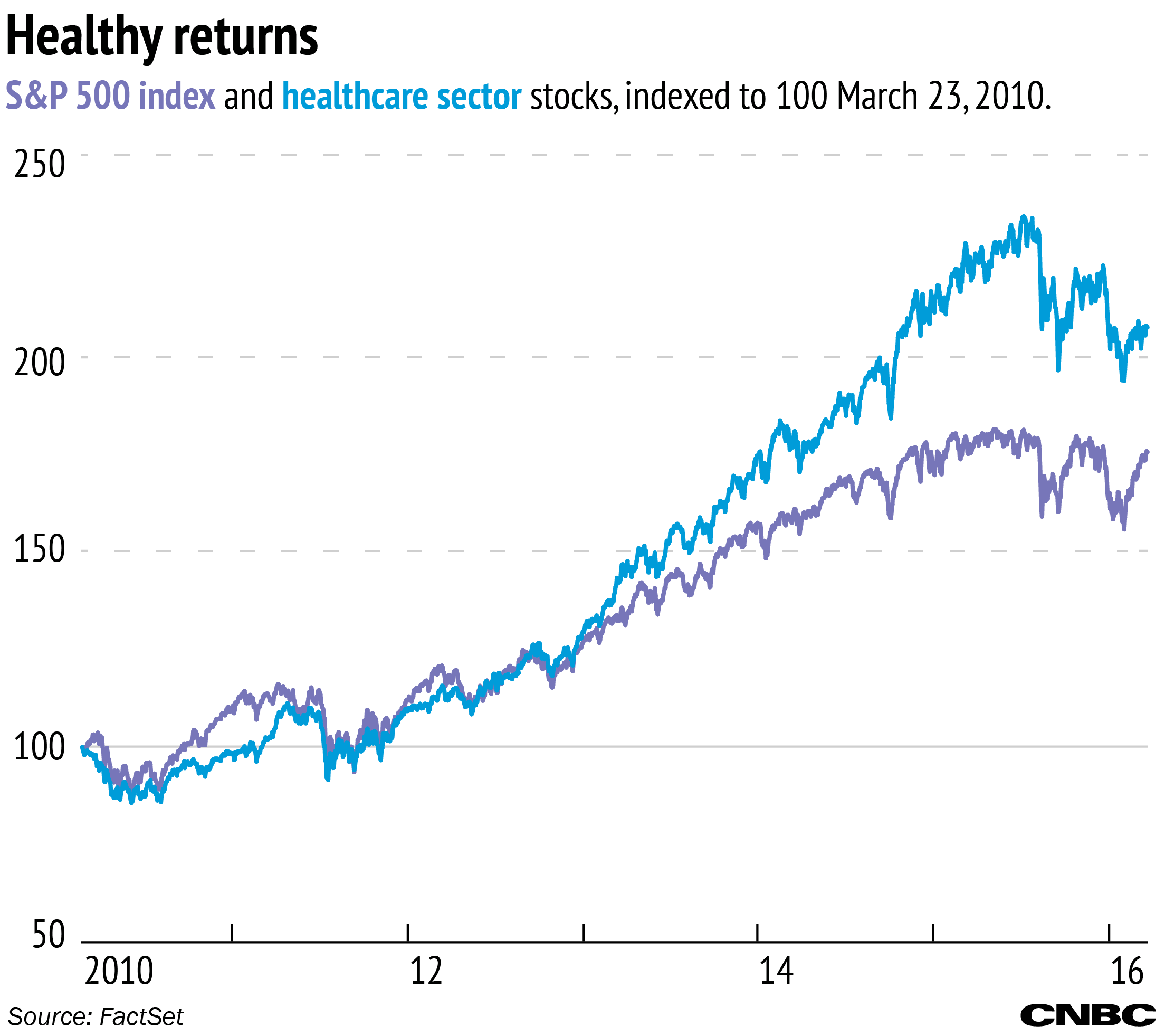

But how does that investor anxiety hold up in the real world? It depends on the vantage point. Health care has held up well since the unveiling of Obamacare, but has done poorly since the election season kicked off.

Investors are not dumping stocks in pharmaceuticals, medical equipment and biotech.

There's also doubt whether a Republican will be able to repeal the law. So in the long run, that might not be such a healthy investment strategy.