Beyond the differences in who these millionaires are, if we dig a little deeper, we find that they take a much different approach to managing their money than baby boomers.

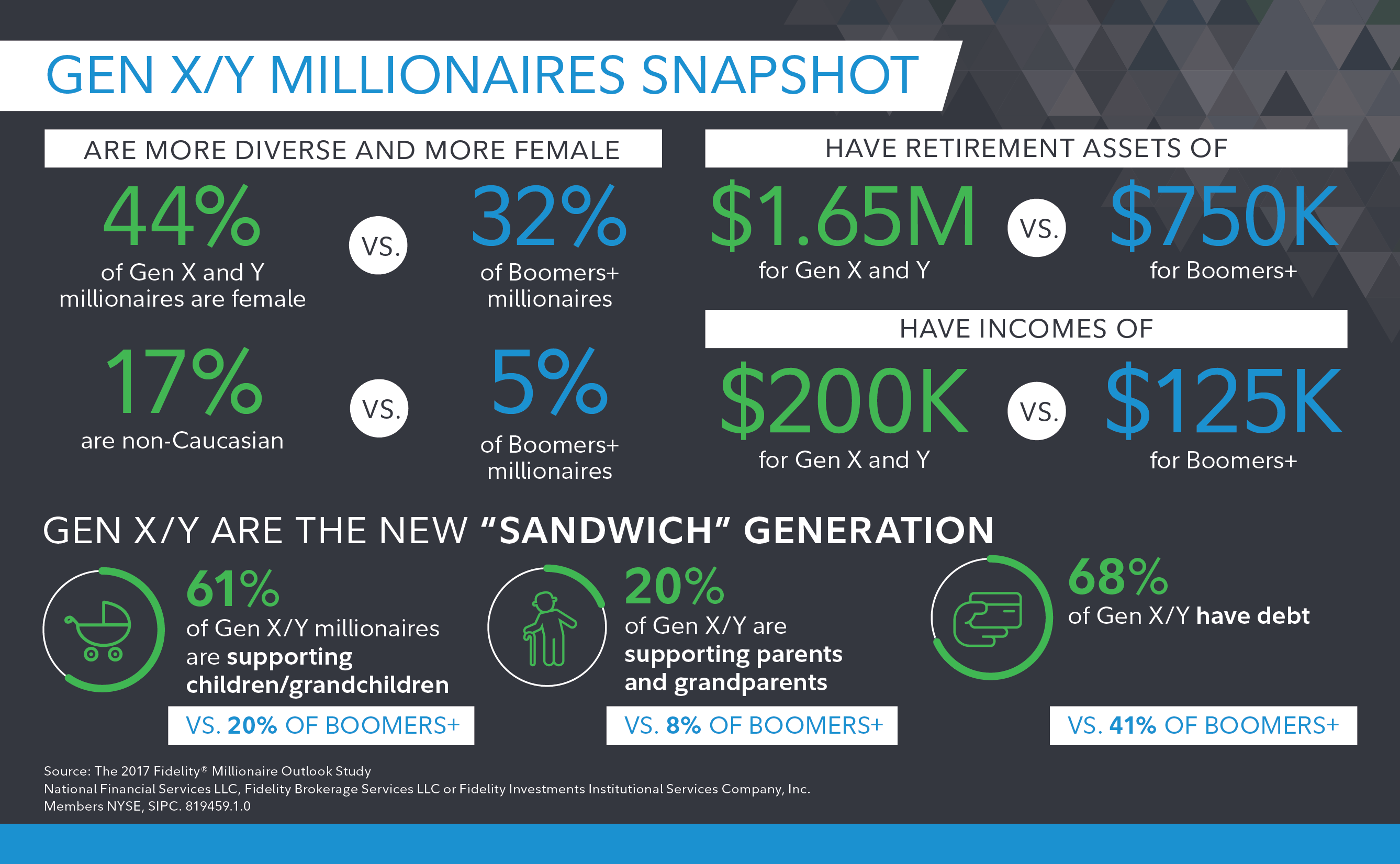

They invest differently: To start, Gen X/Y millionaires have much higher expectations when it comes to their portfolio performance. And as they continue to be "sandwiched" between supporting their children and their parents, all while straddled with debt, can you blame them? These investors are looking for average returns of 16 percent, compared to the 7 percent returns that baby boomers are expecting.

Accordingly, they take more risks with their investments: Fourteen percent of Gen X/Y millionaires have portfolios with derivatives versus just 5 percent of baby boomers. Also, 19 percent of Gen X/Y millionaires have a taste for venture capital, compared to 6 percent of baby boomers. They've also put more faith overseas, with 16 percent of Gen X/Y holding foreign currencies as opposed to only 6 percent of boomers. While baby boomers focus on maintaining their wealth and supporting their current lifestyle, Gen X/Y are still looking ahead to the long-term and are focused on increasing their household wealth and providing for their family's financial security.

More from Active/Passive:

Indexing still on top, but active management plays role

Why traditional investment strategies don't work

I am a lazy, cheap investor. Here's why.

They expect more: With great return expectations come great advisor expectations, and this is where we see another major difference in these two generations. Sixty-two percent of Gen X/Y millionaires want their financial advisor to provide more services, compared to 25 percent of boomers. Those services could be anything from tax filing to financial planning and life coaching. Gen X/Y millionaires are looking for a more holistic approach to managing all aspects of their financial well-being, not just someone to invest assets on their behalf.

And here's the good news for advisors: The Gen X/Y cohort is not expecting these services for free. They are willing to pay more for an advisor if:

- "They help motivate me to reach my goals";

- "They would be the CFO/CEO of my financial life"; and

- "They would help me make better health-care decisions in order to manage costs more effectively."

Technology is a must-have. Not surprisingly, technology plays a huge role in Gen X/Y's satisfaction with their advisor. Nine percent of them are already using a digital advisor (versus only 2 percent of boomers), while a whopping 53 percent say they would find a new advisor if theirs wasn't using technology to enhance services. (I was surprised that number wasn't 100 percent.) Gen X/Y are looking for access to their financial information so they can "visit" their money when they want to.